Omotoyosi Popoola

Feb 11, 2026

Getting access to quick cash in Nigeria has become easier than it was a few years ago, but one question keeps coming up:

Can you really get an online loan with NIN only in Nigeria?

With rising living costs, unexpected bills, and urgent needs, many Nigerians are turning to loan apps in Nigeria for fast, convenient financial support. Still, confusion remains around loan requirements, especially whether your National Identification Number (NIN) is enough. This blog post breaks it all down, clearly, honestly, and without hype.

What Does “Online Loan with NIN Only” Really Mean?

When people search for an online loan with NIN only, they’re usually asking one of two things:

Can I get a loan without paperwork, guarantors, or collateral?

Do loan apps in Nigeria actually approve loans using just NIN for verification?

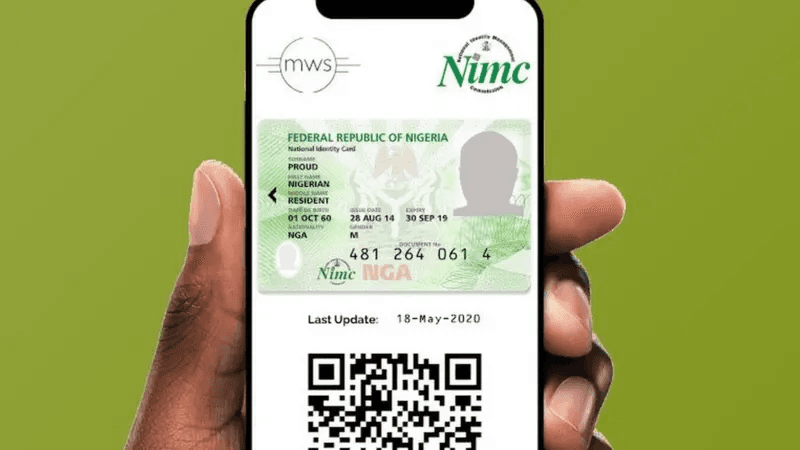

In practice, NIN is used as a primary identity verification tool, not a magic pass. Some reputable loan apps in Nigeria rely on NIN to confirm:

Your identity

Your basic personal details

Your eligibility to use digital financial services

This is why many modern loan apps now describe their process as NIN-based verification, rather than “NIN only.

Can You Get a Loan with NIN in Nigeria Without Collateral?

Yes, some digital lenders offer a loan without collateral, especially for personal loans and urgent loan needs.

These lenders focus on:

Identity verification (often via NIN)

Responsible borrowing patterns

Digital credit assessments

This approach allows borrowers to access:

Instant loan approvals

Small to medium loan amounts

Short-term repayment plans

Fair, low-interest loans based on risk profiling

However, legitimate lenders will still carry out checks to ensure responsible lending.

How Loan Apps in Nigeria Use NIN for Online Loans

Here’s what typically happens when you apply through a loan app in Nigeria:

You download the app and create an account

You provide your NIN for identity verification

The app assesses eligibility using automated systems

If approved, funds are disbursed, often within minutes

Loans that use NIN verification work well for quick, short-term needs. When you’re applying for a higher loan amount or need more flexible terms, QuickCheck offers a secure option with BVN verification.

Are Loan Apps That Use NIN Safe?

This is a very valid concern.

Reputable loan apps in Nigeria:

Use NIN strictly for identity verification

Follow data protection regulations

Are transparent about interest rates and repayment terms

When choosing from the best loan apps in Nigeria, always check for:

Clear privacy policies

Transparent pricing

Customer support

Responsible lending practices

Avoid apps that promise “no checks at all”; that’s usually a red flag.

Instant Loans vs Traditional Bank Loans

One reason Nigerians prefer online loans is convenience.

Instant loan apps offer:

Faster approvals

No physical paperwork

No collateral requirements

Easier access for everyday needs

Traditional banks, on the other hand, often require:

Multiple documents

Longer processing times

Physical branch visits

For short-term personal loans and urgent expenses, digital lenders are often the practical choice.

Are There Low-Interest Loan Apps in Nigeria?

Interest rates vary depending on:

Loan amount

Repayment duration

Borrower profile

Some top loan apps in Nigeria reward responsible borrowers with:

Lower interest rates over time

Higher loan limits

Flexible repayment options

This is why building a good borrowing history matters.

Getting a loan with NIN in Nigeria is no longer complicated, but it’s important to understand how the process really works. An online loan with NIN only is best seen as simple, digital, and identity-based, not unregulated or risk-free. By choosing trustworthy platforms and borrowing responsibly, you can access fast financial support without unnecessary stress. QuickCheck is designed to balance speed, fairness, and trust, making us a popular option among digital borrowers.

FAQs

1. Can I get an online loan with NIN only in Nigeria?

You can apply using your NIN as a primary form of identification, but reputable lenders may still carry out additional checks to promote responsible lending.

2. Are online loans safe in Nigeria?

Online loans are safe when taken from regulated platforms that follow data protection and ethical recovery practices. QuickCheck is fully compliant with the Nigeria Data Protection Act (NDPA) and is committed to safeguarding your data and privacy.

3. Do I need collateral?

You do not need to submit any documents to get a loan. With QuickCheck, you can access an urgent loan with no collateral or paperwork required.

4. Are loan apps better than banks for urgent loans?

For short-term and emergency needs, instant loan apps are often faster and more accessible than traditional banks. Download the QuickCheck app today for instant loans.